The Pkf Advisory Services Ideas

The Pkf Advisory Services Ideas

Blog Article

All About Pkf Advisory Services

Table of ContentsHow Pkf Advisory Services can Save You Time, Stress, and Money.Getting My Pkf Advisory Services To WorkIndicators on Pkf Advisory Services You Need To KnowFascination About Pkf Advisory ServicesHow Pkf Advisory Services can Save You Time, Stress, and Money.

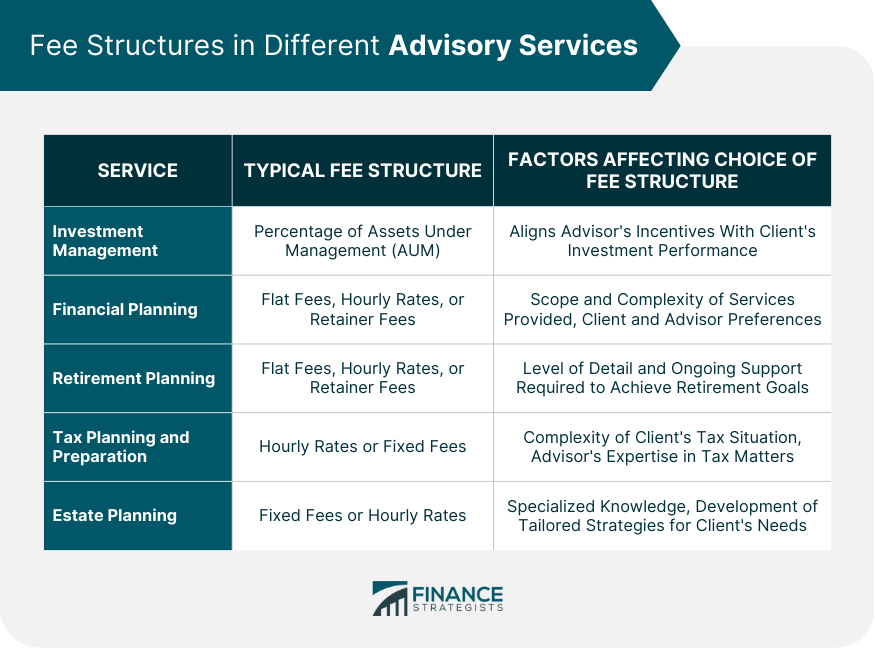

If you're looking for extra info past what you can discover online, it's easy to obtain begun with an in-depth, tailored economic plan that you can examine without cost or dedication. Enjoy the ongoing support of a dedicated consultant in your corner.The complete price you are anticipated to pay, consisting of the internet advisory cost and the underlying fund charges and costs, is around 1.00% of properties under administration. For extra information on fees and expenditures of the solution, please check out the Charges and Compensation section of the. The T. Rowe Rate Retired Life Advisory Service is a nondiscretionary financial planning and retired life revenue planning service and an optional took care of account program offered by T.

Brokerage firm makes up the Retirement Advisory Solution are offered by T. Rowe Cost Investment Solutions, Inc., member FINRA/SIPC, and are lugged by Pershing LLC, a BNY Mellon company, participant NYSE/FINRA/SIPC, which serves as a clearing up broker for T. Rowe Cost Financial Investment Solutions, Inc. T. Rowe Rate Advisory Solutions, Inc. and T.

The Pkf Advisory Services Diaries

Giving guidance is an important part of IFC's strategy to produce markets and activate personal investment. Via this work, we aid develop the necessary problems that will certainly draw in one of the most personal resources, enabling the personal field to expand. IFC is moving to an extra critical strategy, methodically connecting our advising programs to the best needs determined in World Bank Group country and industry techniques.

Financial suggestions can be beneficial at turning points in your life. Like when you're beginning a family, being retrenched, intending for retired life or taking care of an inheritance.

All about Pkf Advisory Services

Once you've concurred to go ahead, your financial advisor will prepare a monetary plan for you. You need to constantly really feel comfortable with your adviser and their guidance. PKF Advisory Services.

Put a time limitation on any kind of authority you offer to get and market financial investments on your part. Urge all correspondence concerning your investments are sent to you, not just your adviser.

This might take place throughout the meeting or digitally. When you go into or renew the recurring fee arrangement with your adviser, they ought to define just how to finish your partnership with them. If you're transferring to a new advisor, you'll need to arrange to transfer your financial records to them. If get more you require assistance, ask your advisor to describe the process.

The Greatest Guide To Pkf Advisory Services

Several possessions come with liabilities connected. The total procedure aids build possessions that don't become a burden in the future.

Why? Like your go-to auto guy, economic experts have years of training and experience behind them. They have a deep understanding of financial items, market movement, and run the risk of monitoring so you can trust that the choices that compose your financial plan are made with confidence. Just how will you know these decisions are made with your benefit in mind? If your economic advisor is a fiduciary, then they are legally bound to act in your benefit not their own.

What Does Pkf Advisory Services Do?

This is what you can use to try the sushi put the road or see your favored band at Red Rocks. PKF Advisory Services. When it comes to tax obligations, Website an excellent monetary consultant will guarantee that you're only paying the minimum quantity you're called for to pay, assisting you put some of your hard-earned refund in your pocket

The possible worth of monetary recommendations depends upon your financial situation. Whether you're simply getting began or well right into retirement, getting skilled guidance or a consultation about your funds can be advantageous at every phase of life. Below are five usual reasons to hire an economic expert. You need help establishing monetary goals for your future You're unsure just how to spend your money You remain in the middle of (or planning for) a major life occasion You need liability or a neutral consultation You just do not like dealing with money To determine if image source dealing with a financial consultant is right for you and make sure a successful connection, the finest thing to do is ask great inquiries up front.

Right here are a couple of instances of inquiries you can ask an economic consultant in the very first meeting. A financial advisor who is a fiduciary is required by regulation to act in your ideal interest.

Report this page